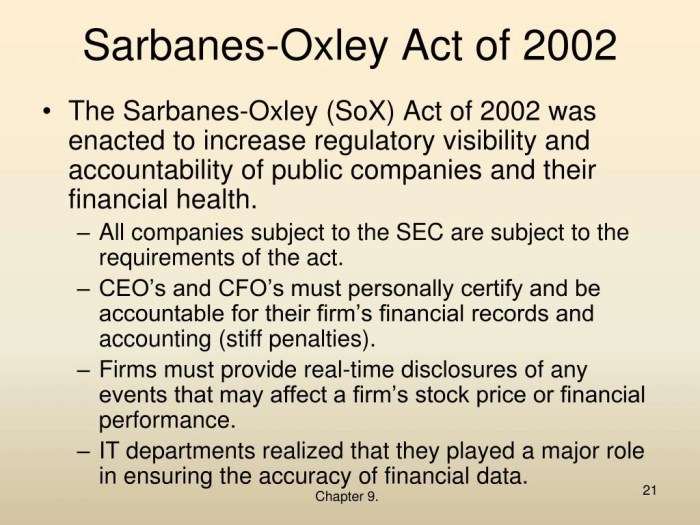

The sarbanes oxley act makes it illegal for employers to – The Sarbanes-Oxley Act of 2002 (SOX) introduced significant reforms to corporate governance, including provisions that make it illegal for employers to retaliate against employees who report violations of securities laws or other illegal activities. This landmark legislation has played a pivotal role in protecting whistleblowers and ensuring the integrity of financial reporting.

This article delves into the specific actions prohibited by SOX, the protections afforded to whistleblowers, and the consequences of violating these provisions. It also examines the impact of SOX on corporate governance and internal controls, highlighting the Act’s enduring importance in safeguarding the public interest.

Prohibited Acts for Employers: The Sarbanes Oxley Act Makes It Illegal For Employers To

The Sarbanes-Oxley Act prohibits employers from engaging in certain actions that could hinder the accuracy and integrity of financial reporting.

Specific prohibited acts include:

- Falsifying or destroying financial records or documents.

- Interfering with internal investigations or audits.

- Coercing or retaliating against employees who report violations.

Consequences of violating these provisions can include fines, imprisonment, and civil lawsuits.

Whistleblower Protections

The Sarbanes-Oxley Act provides robust protections for whistleblowers who report violations of the Act.

Employees can report violations:

- Internally to their supervisor or the audit committee.

- Externally to the Securities and Exchange Commission (SEC) or the Department of Justice.

Whistleblowers are entitled to:

- Protection from retaliation, such as termination, demotion, or harassment.

- Monetary awards if their information leads to successful enforcement actions.

Corporate Governance Reforms

The Sarbanes-Oxley Act introduced significant corporate governance reforms to strengthen the oversight of public companies.

Key reforms include:

- Strengthening the role of the audit committee in ensuring the accuracy of financial reporting.

- Increasing the accountability of CEOs and CFOs for the accuracy of financial statements.

- Requiring independent audits of internal control systems.

Internal Controls and Financial Reporting

The Sarbanes-Oxley Act requires public companies to establish and maintain effective internal controls over financial reporting.

Internal controls include policies and procedures designed to:

- Prevent errors and fraud.

- Ensure the accuracy and completeness of financial information.

- Promote transparency and accountability.

Penalties and Enforcement

The Sarbanes-Oxley Act provides for severe penalties for violations, including:

- Fines of up to $5 million and imprisonment for up to 20 years for individuals.

- Fines of up to $25 million for corporations.

- Disgorgement of ill-gotten gains.

The SEC is responsible for enforcing the Sarbanes-Oxley Act and has brought numerous successful enforcement actions.

Frequently Asked Questions

What specific actions are prohibited by SOX?

SOX prohibits employers from retaliating against employees who engage in protected activities, such as reporting violations of securities laws, fraud, or other illegal conduct.

What protections are provided to whistleblowers under SOX?

SOX provides various protections to whistleblowers, including anonymity, reinstatement, back pay, and compensatory damages.

What are the consequences of violating SOX’s whistleblower protection provisions?

Violating SOX’s whistleblower protection provisions can result in significant penalties, including fines, imprisonment, and disbarment from practicing law or accounting.